Mortgage Payment Holidays

30 Nov 2020

Budgeting for Buying Versus Renting a Property

28 Oct 2021A first-time buyer mortgage is a type of financing designed specifically for individuals who are purchasing their first home. With this type of mortgage, lenders will often offer incentives in order to secure your business.

These incentives may include a free valuation, reduced / no arrangement fees, lower interest rates where family are assisting with the deposit or providing equity security from their property and cashback specifically for being a first-time buyer.

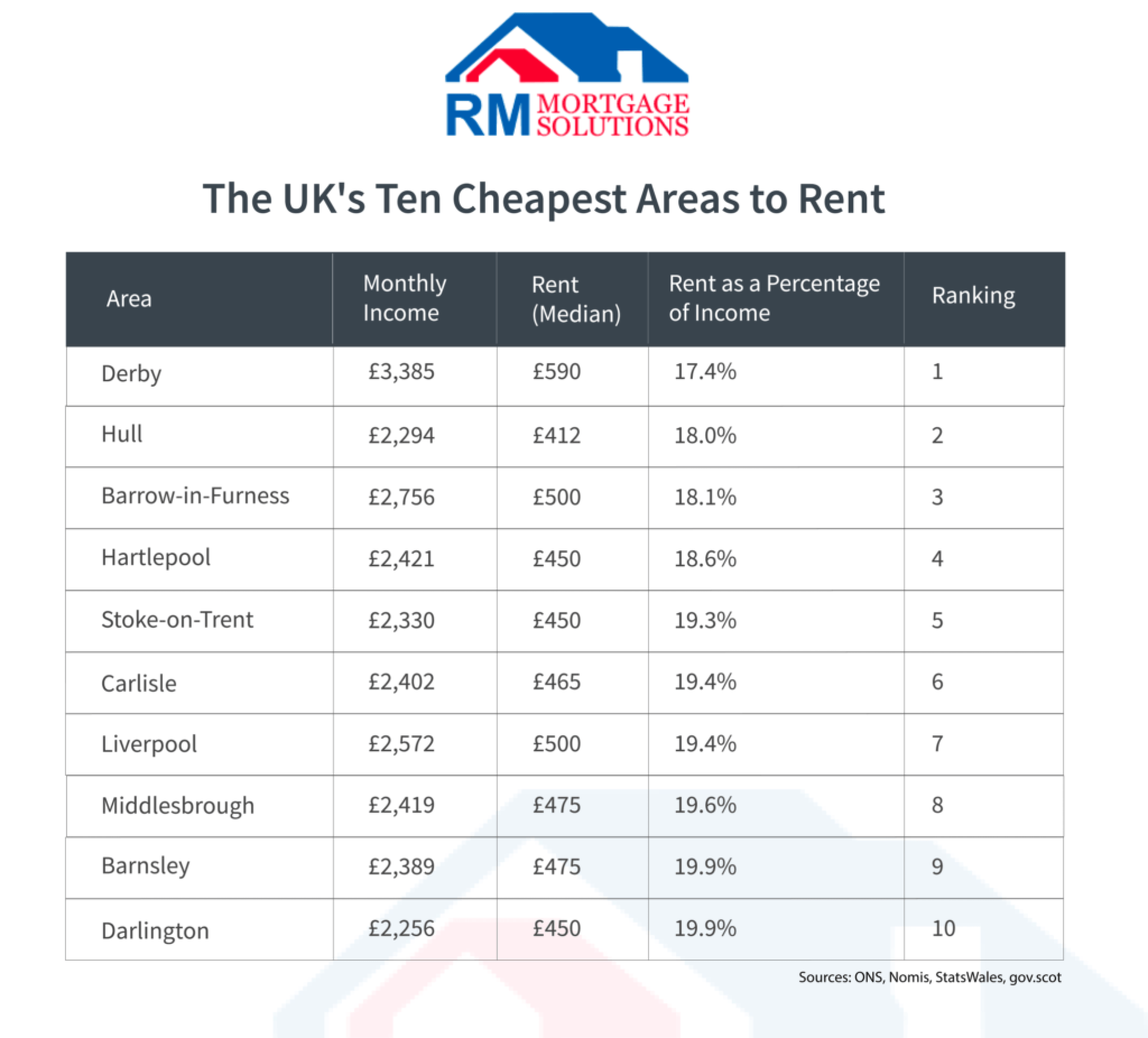

The areas with the most affordable rent

Residents in Derby spend the lowest proportion of their salary on rent

Overall, residents in Derby spend an average of 17.4% of their salary on rent. This is almost half of the UK average across towns and cities at 33.3%. This city is one of the few UK areas that strikes a balance between high average salaries and lower rental costs, resulting in affordable living.

Hull has the lowest average rent of any uk town/city

On average, rent costs just £412 per month in Hull. This is under half the UK average of £854, and 18% of the average salary in the area. Awarded the title of City of Culture in 2017, Hull has seen plenty of investment over the past decade, with a historic old town, museums and bars/clubs encouraging people moving here to stay.

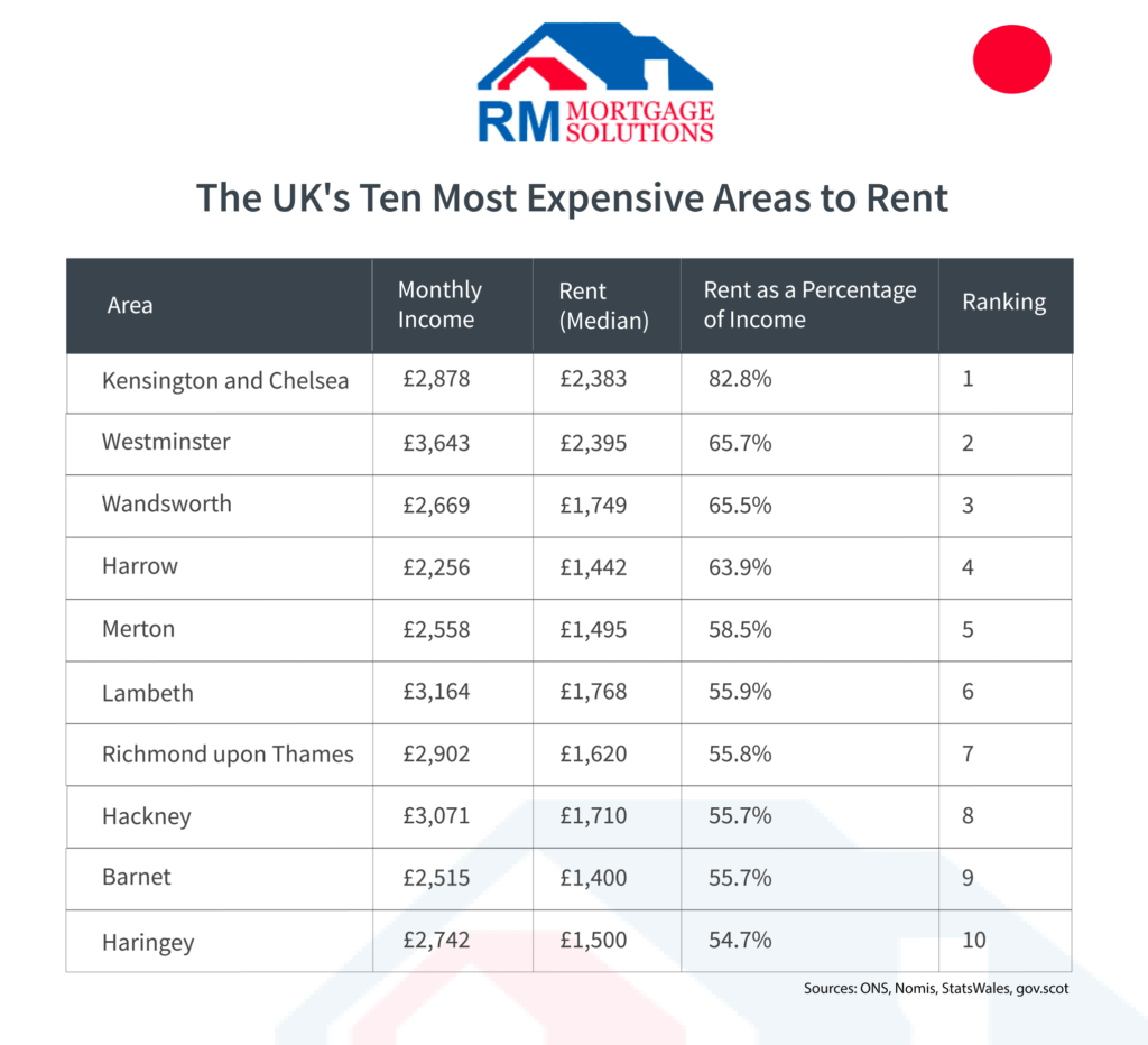

Where will you pay the most rent?

Residents in Kensington and Chelsea have the highest spend on rent versus monthly income of anywhere in the UK. The average rent costs £2,383 per month, while the standard monthly income is £2,878. This means 82.8% of the average workers’ wages are spent on rent if they live and work in this area. The solution to this is commuting to Kensington and Chelsea from London Boroughs with much lower rent, or living there and finding higher-paid work in the City of London.

When averaging rental costs and wages across all London Boroughs, London sees high wages of £3,162 per month and rental costs of £1,435 per month – a whopping 45.4% of the average salary, the highest percentage of any UK city.

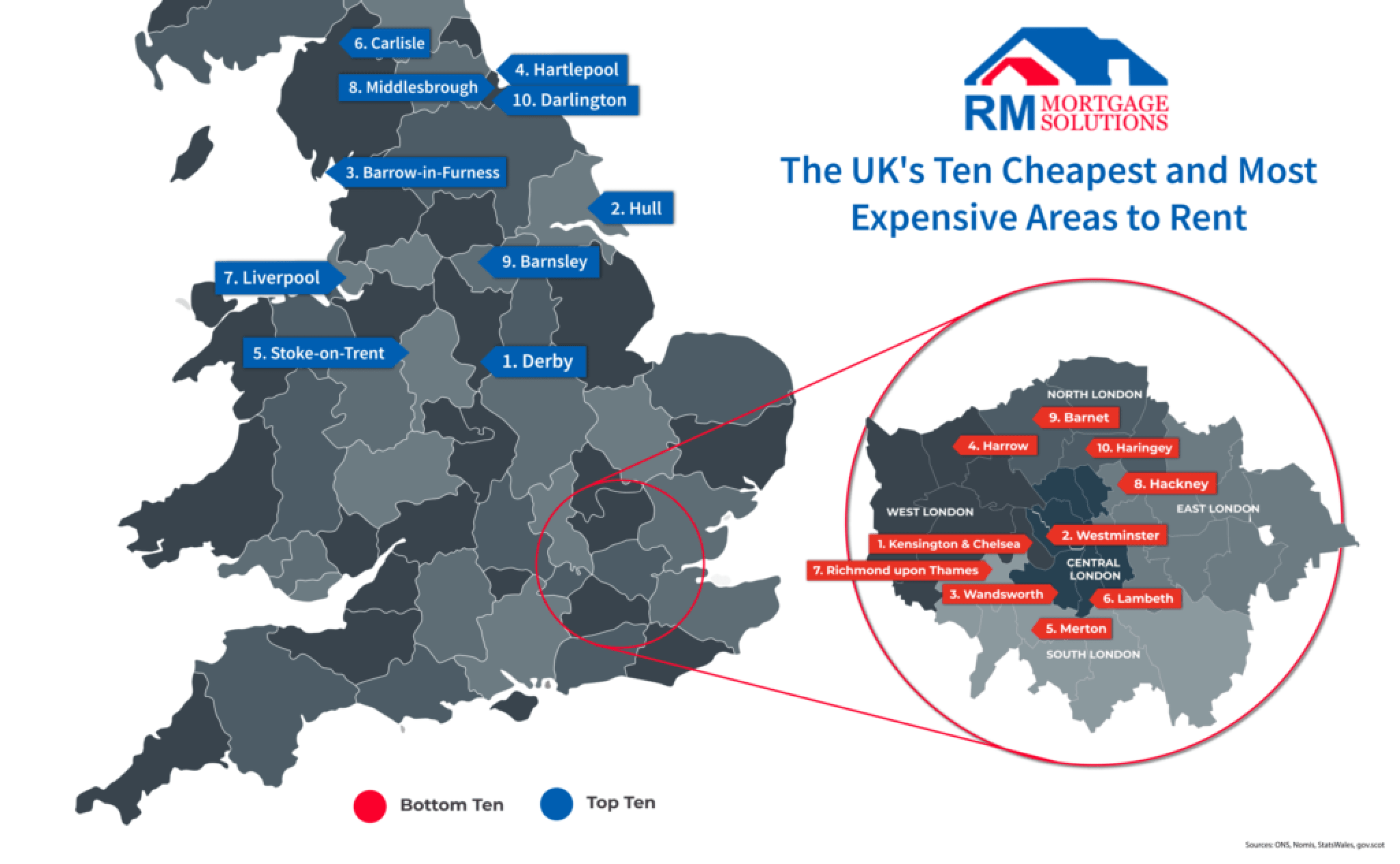

Overall, the UK areas with the highest percentage spend of salary on rent are all in London. In comparison, all of the UK areas where a lower percentage of people’s salary is spent on rent range from Midlands cities such as Stoke-on-Trent and Derby, to further north.

Richard Moring, Director at RM Mortgage Solutions Ltd, has this to say: “Ultimately, moving location is a balancing act that doesn’t just come down to cost. Prioritising certain elements or making a checklist of likes and dislikes that you can tally up are both great ways to decide if you’d like to live in one area over another.

“If you’re unsure about an area, consider testing the water by renting. A lot of time and money goes into buying a house, from researching lenders to completion. Taking the time to experience an area can be invaluable when deciding which street, part of town or property type you would like to live in.”

About RM Mortgage Solutions LTD

RM Mortgage Solutions are a firm of mortgage brokers based in the Birmingham area. They provide whole of market advice to individuals on UK mortgages, remortgages, buy to let, protection and general insurance through carefully considering the client’s situation, needs, and priorities before making appropriate recommendations. Within their mortgage advice, they offer first time buyer mortgage and home mover mortgage advice. The team at RM Mortgage Solutions also offer advice on equity release and protection. Enquire for further information.

RM Mortgage Solutions Ltd is authorised and regulated by the Financial Conduct Authority and is entered on the FCA register under reference 911918.

Methodology

View the full dataset: RM Mortgage Solutions most affordable places to rent in the UK Data

- Rental costs are taken from ONS, Scottish Government and Stats Wales datasets

- Weekly earnings are taken from ONS datasets

- Any towns or cities without full figures for each category have been excluded from the results

Share this post